Boston Saves

We empower families to save and plan for their children’s futures with the support of their City, schools, and community.

Boston Saves is the City of Boston's children’s savings account program. It helps families save and plan for their child's future by giving each Boston Public Schools (BPS) K2 kindergartner an account with $50. Families can get even more money for their child, called Boston Saves Dollars, and track those savings in the Boston Saves Savings Center. This money becomes available once a student finishes high school (or ages out of special education services) to pay for their next steps in education or career training.

Eligibility

Every child entering K2 kindergarten, 1st, 2nd, 3rd, 4th, 5th grade, or 6th grade at BPS district schools will receive a Boston Saves account. At certain Boston Saves “pilot” schools, students in higher grades will also have accounts because their schools started the program earlier. Students who belonged to an eligible pilot school cohort, including Haynes EEC and West Zone ELC, and have since left that school, also keep their Boston Saves account. See this table to determine if your child belongs to an eligible pilot cohort.

How to save for your child’s future

Welcome, Boston Saves families! We are so glad you have started planning now for your child’s future college or career training. Here are a few ways you can start planning and saving for your child’s future with Boston Saves.

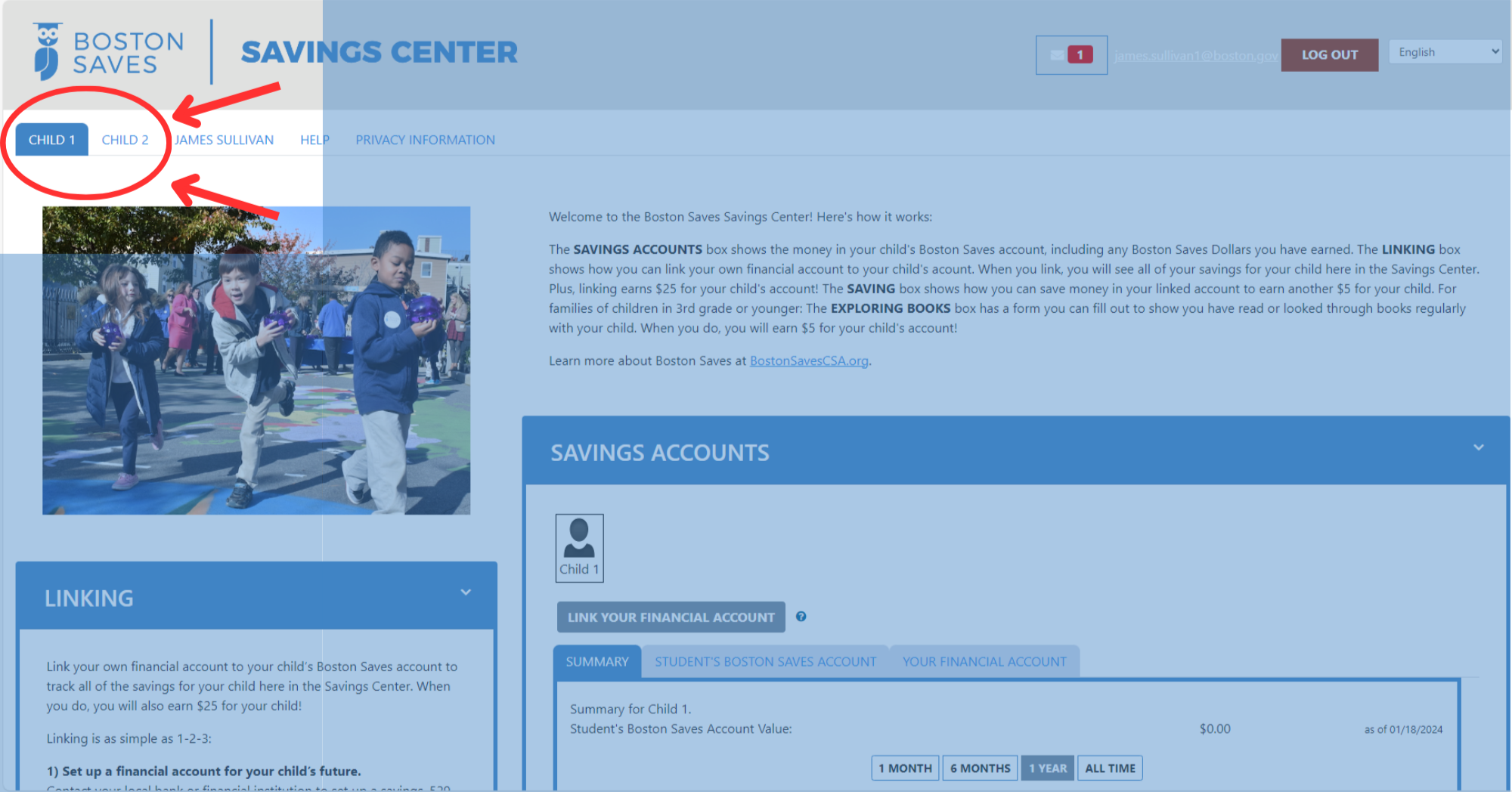

Log in to the Savings Center. When you log in to the Savings Center, you can see the money in your child’s Boston Saves account. You can also link a financial account of your own. This way, you can see all of your savings for your child in one place online.

Please note: Families can now see the accounts for multiple children in the top left navigation bar in the Savings Center.

Open a financial account for your child’s future. Your child will have a Boston Saves account for their Boston Saves Dollars. But, to save your own money for your child, you will need to open a financial account for their future. This can be a savings, checking, or 529 account. Boston Saves and Metro Credit Union also offer a custodial account that does not need a social security number or identification card. Whichever kind of account you open, be sure to set up online banking so that you can log in to your account on the internet.

Get Boston Saves Dollars for your child. You can increase the $50 in your child’s Boston Saves account to as much as $115 in the first year by participating in incentives. There are three ways to get extra Boston Saves Dollars:

- Link a financial account to your child’s Boston Saves account online ($25)

- Save $25 for your child in a three-month period ($5/period, up to $20/year)

- Explore books with your child for 20 days per month in a three-month period ($5/period, up to $20/year)

Why use the program

A culture of student success

Our vision is to create a citywide culture that supports the educational and career aspirations of Boston’s children and their families. We do this by empowering families to save and plan for their children’s futures with the support of their city, schools, and community.

Research shows that:

- families with children’s savings accounts are more likely to see college as a goal for their children, and

- low-income children with $500 or less in a savings account for college are three times more likely to enroll in college. They are also four times more likely to graduate from college.

Boston Saves Office Hours

Office HoursFinancial Literacy Initiative for 9th Graders

The cohort of Boston Public Schools (BPS) 9th graders with Boston Saves accounts is invited to participate in a new Financial Literacy Incentive sponsored by Metro Credit Union. Eligible students will receive an invitation email from Boston Saves. To participate, follow these steps:

-

Log in to the Boston Saves online platform (directions below).

-

Complete a short online class to increase your financial literacy. We will email a class to you each term. Look for an email from bostonsaves@boston.gov.

-

Receive $15 in your Boston Saves account.

You can earn up to $60 this year—and you can keep earning $60 per year through the end of high school. You’ll be able to use this money for college or career training after graduation.

How to log in:

-

Look for an email from bostonsaves@boston.gov with the subject line “Invitation to the Savings Center for Boston Saves”. It has your personalized link. Click on that.

-

Or, go directly to the Savings Center website and log in with your zip code, birthday, and SASID number. You can find your SASID number in ASPEN or by emailing bostonsaves@boston.gov.

-

Be sure to choose “Student” as your user type.

We’d love for you to join in and start earning! If you have questions, email us at bostonsaves@boston.gov. If you believe you are an eligible 9th grader and did not receive an invitation email, contact us at bostonsaves@boston.gov.

Reading Incentive For K2-3rd Graders

How it works:

Read with your child (K2-3rd graders) for 20 minutes a day, 20 days per month, each quarter, and earn money for their Boston Saves account. Eligible families can earn $5 each quarter. That’s up to $20 a year! The quarters go as follows:

- October-November-December

- January-February-March

- April-May-June

- July-August-September

To redeem the incentive each quarter:

- Log in to the Savings Center.

- Fill out the Exploring Books form.

- Boston Saves will add the $5 to your child’s Boston Saves account within 1-2 weeks.

Why this matters:

Exploring books with your child can improve their reading skills and success in school. Studies show that if a child is on track with their reading skills by the third grade, they are 4 times more likely to finish high school.

Become a Boston Saves Family Champion

What is a Family Champion?

Boston Saves utilizes a network of Family Champions across BPS schools to promote Boston Saves, assist families in using the program, and encourage families to save for their children’s futures. Family Champions receive training and technical support from the Boston Saves team and represent Boston Saves in Boston Public Schools and at community events. In return, Family Champions receive $100 in gift cards for each event/two hours of online outreach they participate in and $50 in gift cards for each training workshop, gain valuable experience, and learn to grow their own money.

Who can be a Family Champion?

Anyone excited to represent Boston Saves to other families in their school and community is eligible to be a Family Champion. Family Champions must be committed to attending three training workshops and representing Boston Saves at least three events or through six hours of outreach throughout the school year.

What does a Family Champion do?

- Participate in 3 (2 hour) training workshops and provide feedback throughout the year to help shape and improve the program.

- Represent Boston Saves at 3+ events throughout the school year and/or participates in 6 hours of online outreach.

- Educate families on Boston Saves and provide technical assistance on how to engage with it.

- Maintain communication with your Family Champion Coordinator and School Champion.

- Engage at least 15 other families in the Boston Saves program.

What are the benefits?

- Earn $100 in gift cards for each event/2 hours of outreach you participate in and $50 for each workshop.

- Build financial empowerment and resilience, as well as a college-going mindset, within the community.

- Get a free Financial Check-up and learn about Boston’s other financial and career empowerment resources.

- Network opportunities with Boston Public School, City of Boston staff, and other Family Champions.

- Gain volunteer experience that can strengthen your resume.

Frequently Asked Questions

FAQsEach new K2 kindergarten class in BPS gets Boston Saves accounts. These accounts stay with the students as they grow older. This means that in the first year of the program (2019-2020), only K2 kindergarten students had accounts. In the second year, it was students in K2 and 1st grade. In the third year, students in K2, 1st, and 2nd grade, etc.

At certain “pilot schools,” some students in higher grades are also able to get Boston Saves accounts because their schools started the program sooner. See this table for details.

All BPS students and their families will be able to make use of the program’s tips and events.

No, not for being in the same family. A student’s ability to get a Boston Saves account is based on their grade and school. (See the table on the homepage to learn more.)

A family of a student who is able to get a Boston Saves account does not need to sign up. Their child will get a Boston Saves account without having to do anything else.

If a child leaves Boston Public Schools, their Boston Saves account will not be able to get any new Boston Saves Dollars, but any Boston Saves Dollars already in the account will stay. The student can still get this money when they start college or career training.

A child who joins a class that already has Boston Saves accounts will be able to get an account as well.

Any savings, 529, or checking account can be linked to a Boston Saves account. Families who do not wish to open a financial account of their own may link a custodial account instead.

A custodial account works just like a savings account, except that no social security number or identification card is needed. Also, the money in the account has no effect on a family’s public benefits. This is because the account is held for the child, not by a family, but by the Boston Educational Development Foundation. Contact bostonsaves@metrocu.org to open a custodial account.

A Boston Saves account:

- Is in the child’s name

- Is held by the Boston Educational Development Foundation

- Holds Boston Saves Dollars (money given to a child by Boston Saves)

- Cannot have money taken out until the child enters college or career training

A linked account:

- Is in the name of a family member or the child

- Is held by the bank or other financial institution where it was opened

- Holds a family’s own savings

- Can have money taken out by the family at any time

No. The money in a child’s Boston Saves account stays in the account until the student enters college or career training.

No. The money in a child’s Boston Saves account does not affect a family’s public assistance, because the account is not held by the family. All Boston Saves Dollars are held by the Boston Educational Development Foundation.

The money held in a family’s linked savings, checking, or 529 account, though, can affect their public assistance.

No, the money in a child’s Boston Saves account does not gain interest. A family’s own financial account, though, may gain interest, depending on the kind of account.

The student can start using the money when one of the following things happens:

- The student successfully finishes high school and gets their diploma, GED, or HiSET (the equivalent of a high school diploma).

- If the student received special-education services, they can use the funds when they leave the public school system at age 22, as long as they have a plan for the future (transition planning).

- The student was eligible for transition services, was in BPS past age 18, but chose to voluntarily leave school before completing a diploma/equivalency and before reaching age 22.

The funds can be used for many kinds of costs related to learning a trade or getting an education, including:

-

College or other higher education expenses.

-

Job training programs and apprenticeships (on-the-job training).

-

Other approved programs for education or career training after high school.

for Students with Disabilities

If the student has a disability, the money can also be put into an ABLE (Attainable Savings Plan) Account.

-

This is a special, tax-friendly savings account.

-

It allows people with disabilities to save money and pay for disability-related expenses without losing their eligibility for government benefits (like SSI or Medicaid) that are based on their income and savings.

A student must use the money in their Boston Saves account before they turn 25. If a student does not use their money by this time, they will give up the Boston Saves Dollars in their account. This money will be used by the program to help new students with their savings goals.