Filing for a property tax exemption

Through an exemption, the City releases you from paying part or all of your property taxes.

If you want to file for a property tax exemption, you may have a couple of different options.

What are exemptions?

Background

We can reduce property taxes for residents who meet certain program qualifications. If you want to apply for an exemption, you need to prove that you meet those qualifications.

BEFORE YOU GET STARTED

For Fiscal Year 2024 you have until April 1, 2024, to file an application. You will need to show us any documents that support your application, including birth and death certificates.

If you qualify for more than one exemption, we’ll make sure you get the exemption that saves you the most money. Please keep in mind, if you file a personal exemption application, that does not mean you can postpone paying your taxes.

To qualify for any exemption, you need to show that you have an ownership interest in the property.

What do we consider ownership?

Background

You must have a certain level of financial interest in the property. See the specific exemption programs listed below for more information on determining ownership.

Need to know:

You can own the property by yourself or with someone else. If you hold a life estate you may meet the ownership requirement. If the home is held in a trust, you can only qualify for the exemption if:

- you are a trustee or co-trustee of the trust, and

- you have a sufficient beneficial interest in the home through the trust.

You also will need to show a copy of the trust and a notarized copy of the schedule of beneficiaries.

Exemption Programs

Learn how to apply for the different personal and residential exemptions.

Learn more about how to apply for a 37A Blind exemption.

Learn more about how to apply for a co-op housing exemption

Learn more about how to apply for a 41C elderly exemption.

Learn more about how to apply for a hardship exemption

Learn more about how to apply for a National Guard exemption.

Learn more about how to apply for a residential exemption

How to apply for a statutory exemption for a religious, charitable, benevolent, educational, literary, temperance, or...

Learn more about how to apply for a 17D exemption

Learn more about how to apply for a veteran exemption

How to Apply

Different exemptions have different application deadlines. To see the deadlines for different exemption types, check the individual exemption program websites or visit the Assessing Department calendar page.

If you have questions about the requirements for applying for an exemption, or want to know the status of your application, you can call the Taxpayer Referral and Assistance Center at 617-635-4287.

Complete your application

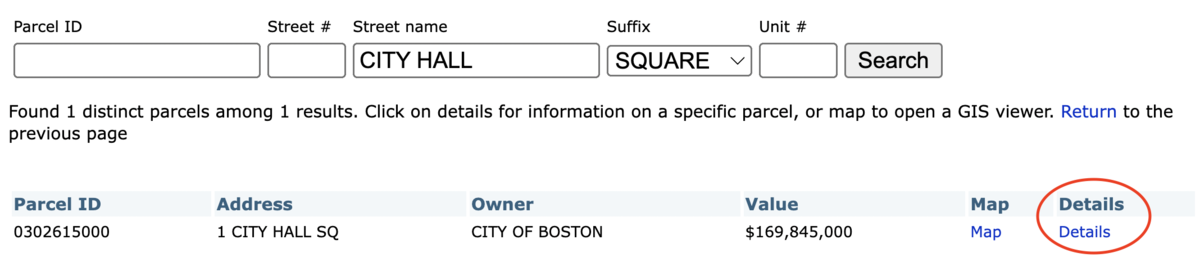

Applications can be downloaded after we issue third-quarter tax bills in December. To download an application, search for and find your property using the Assessing Online tool, then click the "Details" link:

The link to the application will be under the "Abatements/Exemptions" section. For more information on what's possible with Assessing Online, visit our explainer page.

You can also get an application by calling the Taxpayer Referral and Assistance Center at 617-635-4287. Applications can also be completed at City Hall. Remember to bring any additional documents you need for your exemption application.

Submit your application

Bring or mail your completed application and supporting documents to the Assessing Department at City Hall:

ASSESSING DEPARTMENT, ROOM 3011 CITY HALL SQUARE

BOSTON, MA 02201